What we do at Trinity Street

Trinity Street Capital Partners (TSCP) is a real estate investment bank and asset manager of private funds. The firm has extensive experience in structuring all layers of the capital stack for commercial mortgages and private equity for real estate transactions.

The firm originates construction, bridge and permanent commercial mortgages. Trinity Street offers two forms of private equity, preferred and joint venture (JV) equity all types of real estate transactions.

TSCP focuses on the following commercial property types: office, retail, self storage and hotels.

The firm focuses on the following residential property types: multifamily, student housing, build for rent and manufactured housing.

Trinity Street develops and preserves long term relationships with its clients by providing reliable execution and optimal financing structure. Our professionals focus on the client’s individual needs and objectives, as key determinants in structuring the appropriate financing for each transaction. We identify, evaluate and configure the most effective capital structure for each opportunity, while always keeping the clients priorities in mind.

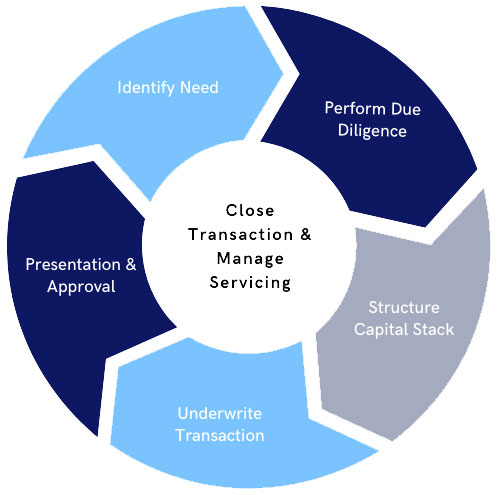

Identify Needs

Evaluate long and short term financial goals with respect to the property.

Perform

Perform property and market due diligence.

Structure

Structure Optimal capital stack.

Underwrite

Underwrite transaction and order 3rd party reports.

Credit

Credit committee presentation and approval.

Closing

Close transaction and manage servicing.